Building materials multinational LafargeHolcim has injected N96 billion into Lafarge Africa Plc as part of financial restructuring aimed at unburdening the balance sheet of the Nigerian subsidiary and supporting its future growth.Lafarge Africa at the weekend announced that it had successfully raised N131.65 billion, achieving 100% subscription to its recent rights issue.

Lafarge Africa had in November 2017 launched a rights issue of N131.65 billion through sale of 3.1 billion ordinary shares of 50 kobo each at N42.50 per share to existing shareholders.

The new shares were pre-allotted to shareholders on the basis of five new ordinary shares for every nine ordinary shares held as at the close of business on November 1, 2017. The acceptance list opened on Friday November 24, 2017 and ran till the close of business on Friday, December 15, 2017.LafargeHolcim, which held the majority equity stake of 72.59% in Lafarge Africa, had earlier indicated interest to fully pick up its rights.Allotment results approved by Securities and Exchange Commission (SEC) indicated that the major foreign shareholder picked up its rights.

The breakdown of the allotments showed that LafargeHolcim and nine other major investors accounted for about 94% of the total subscription.

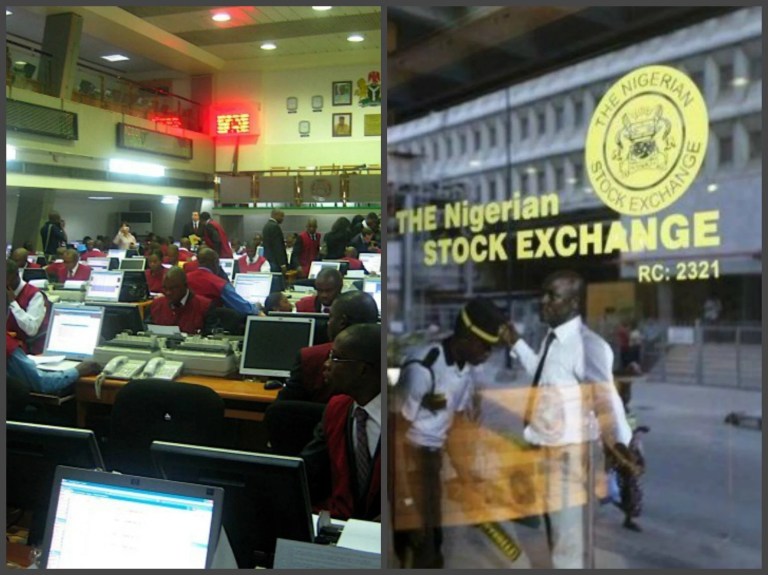

The major investors fully picked up their rights and acquired additional shares through rights trading at the Nigerian Stock Exchange (NSE) and additional primary allotment. There is a strong possibility that the rights issue might have increased LafargeHolcim’s majority stake beyond 73%.

More news

- PART 2: CONCRETE IN THE DESIGN OF A UNIQUE LUXURY HOME IN GEORGE, SOUTH AFRICA

- PART 1: CONCRETE IN THE DESIGN OF A UNIQUE LUXURY HOME IN GEORGE, SOUTH AFRICA

- MVULE GARDENS, AFRICA’S LARGEST 3D-PRINTED AFFORDABLE HOUSING PROJECT

- PART 3: HARNESSING THE POTENTIAL OF HIGH SULPHUR FLY ASH IN CONCRETE PRODUCTION

- PART 2: HARNESSING THE POTENTIAL OF HIGH SULPHUR FLY ASH IN CONCRETE PRODUCTION