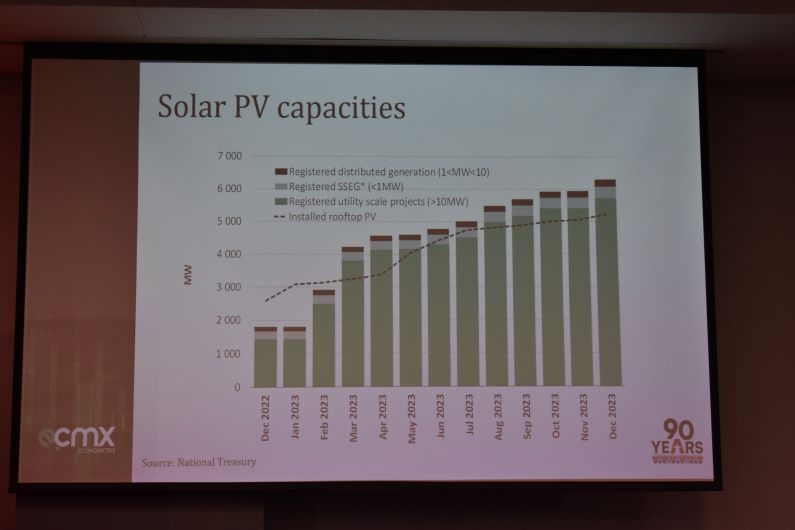

Caption: A slide in economist Azar Jammine’s presentation.

Economist Azar Jammine shed light on the nation’s economic landscape, particularly focusing on the construction sector at the 2024 edition of AfriSam’s national budget presentation. He hosted a Q&A session.

A question posed by a representative of CESA was responded to as follows: It’s undeniable that engineers play a pivotal role in building and sustaining our economy. The lack of representation of engineers in important decision-making forums is indeed a concern. Engineers should have a seat at the table in institutions like chapter nine, alongside other professionals like lawyers and auditors, to ensure that engineering perspectives are taken into account in policy and decision-making processes. This can help address issues of bureaucracy and inefficiency, ultimately contributing to better governance and service delivery.

Furthermore, the decline in construction activity and opportunities for engineers is alarming. To address this, we need to focus on improving education, particularly in maths and science, to cultivate a strong pipeline of skilled engineers. It’s disheartening to see talented engineers leaving the country due to lack of opportunities, and this contributes to the overall stagnation in the economy.

Regarding the issue of the construction mafia and procurement corruption, it’s clear that integrity and transparency in procurement processes are essential to combat such challenges. Procurement policies must be reformed to prevent exploitation and ensure that resources are used efficiently and equitably for the benefit of all citizens. Corruption and state capture have deeply entrenched themselves in various sectors, and addressing these issues requires concerted efforts from government, civil society, and the private sector.

Prioritising the inclusion of engineers in decision-making processes, investing in education and skills development, and tackling corruption in procurement are crucial steps toward building a more prosperous and sustainable future for South Africa.

A question the Master Builders Association in South Africa took the following form: You mentioned infrastructure development, which is crucial for our construction industry. Over the last 5 to 6 years, infrastructure spending has been stagnant, hovering around R700 to R800 billion. With the recent election, it seems to have increased to around R943 billion. My question is, when can we expect to see tangible progress on these projects?

You’ve addressed a question that I’ve long had, and I appreciate the insights. In the construction industry, one of the indicators we often look at is the number of cranes. Interestingly, much of the crane activity you mentioned, particularly around the mainland precinct in Pretoria, is for private projects. However, when we look at the public sector infrastructure on your list, such as schools and hospitals, progress seems slower. Each year, we hear about children unable to attend school due to shortages, whether it’s schools, police stations, or other vital facilities.

Unfortunately, it seems that some municipalities are notorious for misusing funds, diverting them into personal pockets rather than implementing projects efficiently. While official figures may show implementation, corruption often taints these efforts. Additionally, the presence of the construction mafia exacerbates these challenges.

There’s been talk of 67 fast-track projects in infrastructure, spearheaded by the current Minister of Electricity. However, as Master Builders of South Africa, we’re still waiting for updates on these projects. We invited the Minister to report progress on these initiatives, but there seems to be little transparency on their status.

Another question asked, with the recent announcement of global corporate tax reforms, the government anticipates an additional R8 billion in revenue annually once implemented, might this deter foreign investors?

It’s important to understand that the focus of this tax reform is primarily on large multinational corporations, such as Apple, Google, and Microsoft, known for paying low tax rates across different countries. By establishing subsidiaries in various jurisdictions, they’ve managed to avoid paying taxes where they operate. The aim of this reform is to ensure fair taxation and prevent exploitation of countries like South Africa for profit without contributing taxes. While there may be concerns about deterring foreign investment, the anticipated revenue increase of R8 billion is relatively small in the grand scheme of things. Ultimately, it’s about creating a level playing field and holding corporations accountable for their tax obligations.

More news

- PART 2: CONCRETE IN THE DESIGN OF A UNIQUE LUXURY HOME IN GEORGE, SOUTH AFRICA

- PART 1: CONCRETE IN THE DESIGN OF A UNIQUE LUXURY HOME IN GEORGE, SOUTH AFRICA

- MVULE GARDENS, AFRICA’S LARGEST 3D-PRINTED AFFORDABLE HOUSING PROJECT

- PART 3: HARNESSING THE POTENTIAL OF HIGH SULPHUR FLY ASH IN CONCRETE PRODUCTION

- PART 2: HARNESSING THE POTENTIAL OF HIGH SULPHUR FLY ASH IN CONCRETE PRODUCTION