Caption: Economist Azar Jammine shed light on the nation’s economic landscape, particularly focusing on the construction sector.

Economist Azar Jammine shed light on the nation’s economic landscape, particularly focusing on the construction sector at the 2024 edition of AfriSam’s national budget presentation.

In the examination of the 2024/25 budget, Jammine sheds light on the government’s fiscal decisions and their implications for the economy. One notable move is the utilisation of foreign exchange reserves, where a portion of the accumulated funds is redirected towards reducing national debt, thereby easing the burden of interest payments and freeing up resources for other priorities. This strategy reflects a pragmatic approach to leveraging available resources to address pressing fiscal challenges.

Moreover, the imposition of a 15% tax on multinational corporations’ profits aligns with international efforts to curb profit shifting and ensure a fair contribution to national tax revenues. While this measure generates additional revenue for the government, it also underscores South Africa’s commitment to global tax standards and cooperation.

However, the bulk of the tax burden falls on personal income tax, with thresholds unchanged and inflationary adjustments omitted, resulting in higher effective tax rates for many individuals. This approach aims to mitigate revenue shortfalls and sustain public finances amidst economic headwinds, albeit at the expense of taxpayers.

The decision to forego increases in the fuel levy offers modest relief to consumers, albeit insufficient to offset the overall tax burden. Despite the challenges posed by public sector wage demands and social spending pressures, the government maintains a cautious stance, refraining from excessive spending expansions.

One intriguing allocation is the R1.4 billion earmarked for the national health insurance (NHI) scheme, a fraction of the estimated funding required for its implementation. While symbolic, this gesture signals the government’s symbolic commitment to healthcare reform ahead of an election in order to solicit public support without any real substance.

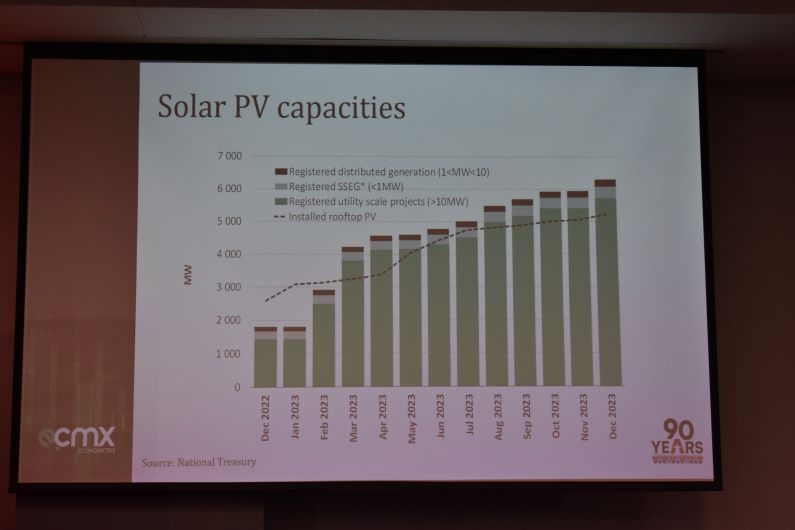

Economic growth projections for the coming years are revised upwards, driven by anticipated improvements in load shedding and infrastructure bottlenecks. Notably, the construction sector stands to benefit from increased investment in renewable energy projects and grid development, offering potential avenues for employment and economic expansion.

The 2024/25 budget reflects a balanced approach to fiscal management, characterised by prudent revenue-raising measures, strategic allocation of resources, and cautious optimism regarding economic prospects. While challenges persist, particularly in relation to tax burdens and expenditure pressures, the government’s response underscores its commitment to fiscal sustainability and economic resilience amidst a dynamic and uncertain global landscape.

Continuing with the analysis, Jammine delves deeper into the distribution of tax payments, highlighting the disproportionate burden borne by a small segment of the population. He points out that a mere 3% of the population contributes 76% of all personal tax collected, showcasing the significant reliance of the government on high-income earners for revenue generation.

Despite this reliance, the government acknowledges the limitations of further taxing this segment and recognises the need to restrain expenditure growth. Jammine explains that expenditure is projected to increase at around 4.5% per annum for the next few years, a rate intended to be more restrained compared to previous forecasts.

The reduction in the budget deficit compared to previous projections is attributed to several factors, including reduced interest payments resulting from the repayment of a chunk of debt. Consequently, the projected debt-to-GDP ratio is expected to peak at a lower level than previously anticipated, offering some relief in terms of fiscal sustainability.

Examining the breakdown of expenditure, Jammine notes that while the share of spending on public service remuneration remains constant at around 31.8% of total government spending, there is a positive trend in capital expenditure. The share of capital expenditure to the total budget is set to rise, indicating the government’s intention to increase its investment in infrastructure projects.

However, Jammine remains cautious about the realisation of increased government spending on capital projects, citing past instances where such intentions did not materialise fully. Nonetheless, there is some optimism as the government allocates a significant sum for public sector infrastructure investment, with a focus on energy, water, sanitation, transport, and logistics.

While there are positive signals in terms of reduced budget deficits and increased allocations for capital projects, there are lingering doubts about the effective implementation of these plans. The government’s ability to translate its intentions into tangible outcomes in terms of infrastructure development will be closely watched, as it plays a crucial role in driving economic growth and fostering long-term prosperity.

Jammine expresses doubts about whether the government will be able to adhere to its commitments, particularly regarding public sector wage increases and infrastructure spending. While there is optimism surrounding increased investment in infrastructure on paper, there are lingering doubts about its actual implementation.

Ultimately, Jammine emphasises that the budget fails to inspire confidence in a significant improvement in economic growth. He highlights the underlying structural challenges facing the South African economy, including corruption, inefficient state-owned enterprises, energy insecurity, transport bottlenecks, and low investment.

Addressing these challenges requires comprehensive reform across various sectors, including governance, infrastructure, regulation, and skills development. Without meaningful progress in addressing these issues, the South African economy is likely to continue facing slow growth and fiscal constraints in the foreseeable future.

More news

- PART 2: CONCRETE IN THE DESIGN OF A UNIQUE LUXURY HOME IN GEORGE, SOUTH AFRICA

- PART 1: CONCRETE IN THE DESIGN OF A UNIQUE LUXURY HOME IN GEORGE, SOUTH AFRICA

- MVULE GARDENS, AFRICA’S LARGEST 3D-PRINTED AFFORDABLE HOUSING PROJECT

- PART 3: HARNESSING THE POTENTIAL OF HIGH SULPHUR FLY ASH IN CONCRETE PRODUCTION

- PART 2: HARNESSING THE POTENTIAL OF HIGH SULPHUR FLY ASH IN CONCRETE PRODUCTION